E Pensions annuities or other periodic payments. As a result dividend yields in the hands of shareholders are exempt from tax.

How Is Foreign Sourced Income Taxed Thannees Articles

Double taxation on foreign dividends is not right.

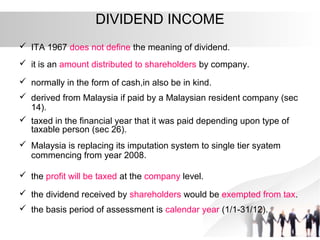

. Companies are not required to deduct tax from dividends paid to shareholders and no tax credits will be available. If employers provide loans to the employees there will be tax on the interest. Inland Revenue Board of Malaysia.

Malaysia is under the single-tier tax system. However Section 10 provides an exemption from taxation for dividends received from Indian companies that were subject to the dividend distribution tax. The Chartered Tax Institute of Malaysia.

One of the most significant proposed changes to our tax system is imposition of tax on foreign sourced income. Lets say you own 1000 shares youd receive. Dividends received by companies and limited liability partnerships.

Individual who received all types of FSI in Malaysia will be exempted from tax - for the period from 1 January 2022 to 31 December 2026 except for those individuals who carrying out partnership business. The Income Tax Act 1967 ITA enforces administration and collection of income tax on persons and taxable income. Dividend Income Update 2019.

Without dividend withholding tax. Malaysia is under the single-tier tax system. Are Capital Gains or Dividends Taxable in Malaysia.

The income tax exemption is effective from January 1 2022 until December 31 2026. The categories of foreign-sourced income that are exempt from income tax are the following. Dividend Income Update 2021.

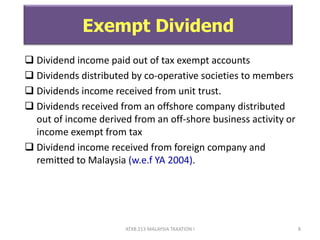

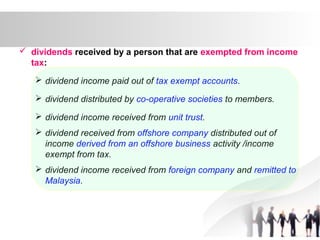

Dividends are exempt in the hands of shareholders. Target company was the ability to claim a refund of tax credits when there was sufficient interest cost to offset the taxable dividend income. Alternatively dividends distributed by a company are taxed at the company level as final tax.

Of course there are dividends or benefits that are tax-exempt such as Tabung Haji ASB or Unit Amanah. Dividends are exempt in the hands of shareholders. The law currently exempts local dividends from income tax due to the single-tier system that Malaysia adopts.

Heres our complete guide to filing your income taxes in Malaysia 2022 for the year of assessment YA 2021. Individuals who earn an annual employment income of more than RM34000 and has a Monthly tax Deduction MTD is eligible to be taxed. However the dividend received will be subject to a 10 tax under Section.

Even when a person retires and doesnt have income from a job anymore their pension and even gratuity payments are still considered part of their income. The Finance Ministry in late December 2021 extended through 31 December 2026 a tax exemption available for foreign-source income for individuals and foreign-source dividend income for corporate taxpayers subject to certain conditions. Do You Need To Pay Income Tax.

Malaysian investors should count themselves extremely lucky as capital gains from your stocks are not taxable. Dividend Income Update 2022. While we expect the Inland Revenue.

As an example Apple decides to pay out 010 distribution per share to investors. Hence dividend yields are exempted from tax in the hands of the. January 7 2022.

If you receive a dividend that is calculated as income youll be taxed because of the dividend earned. Corporate shareholders receiving exempt single-tier dividends can. All types of income received by individual taxpayers.

Companies are not required to deduct tax from dividends paid to shareholders and no tax credits will be available for offset against the recipients tax liability. Here are 5 tax exempted incomes that can easily apply to you. D Rent royalties or premiums.

The relief is provided in response to the coronavirus COVID-19 pandemic. Company and LLP who received Dividend Income as FSI in Malaysia will be exempted from tax - for the period from 1 January 2022 to 31 December 2026. Dividends are taxed at a 20 rate for individuals whose income exceeds 209425 those who fall in either the 35 or 37 tax bracket.

Any capital gains on shares are not subject to tax under the Malaysian Income Tax Act 1967 ITA. The calculation of individual threshold of non taxable income is taking into account after the deduction of annual gross income with eligible individual reliefs and tax rebates. Capital gain is an increase in your.

Well not legally a crime. 100 in dividends 010100 shares. Income tax exemption on dividends will be granted to companies and Limited Liability Partnerships while individuals will be tax-exempted for all types of income including dividend income.

Malaysia has no capital gains tax regime. Double taxation is a crime. As such as a Malaysian you DO NOT need to declare dividend income to LHDN again while filing for personal income tax.

5 4 The breakdown of taxes on qualified dividends is as. The tax exemption would allow individual taxpayers to remit their income back to Malaysia tax-free and encourage them to continue to do so. F Gains profit not falling under any of the foregoing paragraphs.

C Dividends interest or discounts. In Malaysia there is an indirect tax framework that consists of the following core taxes and duties. Once the amendments to the Income Tax Act are passed foreign sourced income that is remitted to Malaysia by Malaysian residents individuals and corporates would be subject to tax starting from 1 January 2022.

Tax concerns for investments in Malaysia - especially for emerging investment vehicles. Services tax is levied at 6 on taxable services supplied by compulsory taxable persons including imported taxable services. But all types of income whether its from your business or profession employment dividends interest discounts rent royalties premiums pensions annuities and others.

Instead it is conventional not to put the same income to tax twice. Dividend Income Update 2020. Dividends distributed by a company is taxed at the companys level as a final tax.

Service tax implemented on 1 September 2018. According to the Income Tax Act dividend income received from a foreign corporation is completely taxable in India.

Individual Income Tax In Malaysia For Expatriates

Foreign Sourced Income What Is Remaining Thannees Articles

A Review Of Capbay P2p Lending In Malaysia Dividend Magic P2p Lending Dividend Types Of Loans

Dividend And Growth Investing And What Are Dividends Dividend Magic

How Is Foreign Sourced Income Taxed Thannees Articles

10 Things Nri Should Know About Portfolio Investment Scheme Pis Nri Saving And Investment Tips Investing Investment Tips Savings And Investment

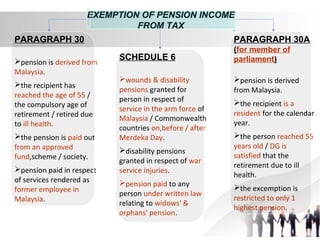

Taxation Principles Dividend Interest Rental Royalty And Other So

Chapter 5 Non Business Income Students

The Top One Percent Net Worth Levels By Age Group Passive Income Investing Spending Problem

Dividend Tax In Malaysia Tax Lawyers In Malaysia

What S Your State S Dividend Income Tax Thinkadvisor

Review Of Pitchin Malaysia S Equity Crowd Funding Platform

Dividends My Blog Dividends My Blog

Taxation Principles Dividend Interest Rental Royalty And Other So

Taxation Principles Dividend Interest Rental Royalty And Other So

Taxation Principles Dividend Interest Rental Royalty And Other So

Best Premier Banking In Malaysia Dividend Magic Banking Relationship Management Dividend